Intraday Calls

Guidelines for Intraday Calls

What Is Intraday Trading?

Intraday Trading is the act of buying and selling a Financial Instrument (Shares / Stock Futures / Index Futures / Stock Options / Index Options), within the same day, or even multiple times over the course of a day, taking advantage of price moves throughout the day.

What is Square off in Trading?

The investors indulging in day trading/intraday trading use square off to close / reverse the position and book profit / loss.

Example of Intra Day Trading:

Suppose a trader buys 100 shares of Reliance Industries on 8th August 2018 at Rs. 1,217 at 9.45 am. The same trader then sells these 100 shares on the same day, say at 2.45 pm at Rs. 1,232. Here, the trader squares off his position in the same trading session and books profits of Rs. 15 per share. As he had 100 shares, he has booked total profits of Rs. 1,500/- This is called as intraday trading.

Advantages of Intraday Trading:

- Flexibility to trade even with a small capital base

- More exposure through higher churn via the intraday trading

- Low brokerage, as some brokers offer as low as one paise brokerage for intra day trades

- Ability to trade according to the current market trend

- Liquidity in account and hence sudden market collapse won’t hurt portfolio

Disadvantages of Intraday Trading

Disadvantages of Intraday Trading are far more and can cause great damage to portfolio. Let us illustrate:

- Long Term Wealth Cannot Be Generated By Short Term Trading: People who buy shares for Intra Day (basically for few hours) are more dependent on the mood of the market and rather than fundamentals. Investors who identify handful of strong investment ideas in 12 months, tend to make more money (return) than people who find new stock to bet on every hour.

- Quality v/s Quantity: Intraday Traders is always focussed on Quantity of trades (making more number of small profitable trades) while LT Investor is focussed on Quality. This reminds us of very old Hindi idiom – “100 sunar ki, 1 lohar ki” (which means one powerful blow is comparable to a hundred smaller blow)

- Magic Of Compounding: We were taught in primary school a Compound Interest Formulae: P(1+R)^N. With this formula, if a person had invested just One rupee at the time Babur invaded India in the year 1526 A.D., then on nominal rate of return of 3% per annum, that one rupee would be now worth over Rs. 18 lakhs, and at 5% per annum return, it would be over Rs. 2,300 crores. That’s the Magic Of Compounding which intraday trader can never enjoy and experience.

- History & Living Legends: Be it Peter Lynch or Jesse Livermore or Warrant Buffet or any other successful investor, who has created “wealth”, has always advocated principal of Long Term Investing. Remember, Creating Wealth is different from Making money: In a stock market, Majority of Wealth is generated by “Waiting” and not by “Buying & Selling”.

Still, for those who would like to allocate some % of portfolio for Intra Day Trading, we have collated some basic tips and strategies for Day Trading:

Basic Tips & Strategies For Intra Day Trading:

Tip No. 1: Be Patient In Booking Profits: As long as the stock is acting right and market is acting right, do not be in a hurry to take profits and try to ride entire day’s movement, as sometimes most of the moves come in last hour of the trading session. Let your profits run!

Tip No. 2: Be Agile In Cutting Losses: If the stock is not acting as anticipated, immediately determine that time is not yet ripe and exit with stop loss principle, depending on your risk – reward that you, as an intraday trader are willing to take.

Tip No. 3: Never Become Involuntary Investor: The essence of intraday trading turning paper profits into real profits, with no open positions to worry about at the end of the day, especially in case of F&O. If stock has not acted as anticipated, do not let it turn into investment. Speculative Trades should never be allowed to turn into Involuntary Investments, just in hopes of recovering cost!

Tip No. 4: Few Is Better Than Many: Avoid spreading your interest in too many stocks. Commonsense dictates that it is far easier to track a Few Stocks versus Many stocks at a time

Tip No. 5: Sister Trades: When you clearly see a move coming in across all the stocks of one particular sector, Act Upon It!

Tip No.6: Classic Rule of Peanuts & Watermelons: Make sure your profits in the size of Watermelons and Losses are in the size of peanuts. If you are doing opposite, probably it’s time to take a break for few days and evaluate your mistakes

Tip No. 7: The Feeling on Uneasiness: Although this point focuses on emotional intelligence rather than Technical and Fundamental triggers, it is highly beneficial. Many a times, one benefits a lot by paying attention to a great degree of uneasiness in a trade, and squaring it off gives a big relief. Do it.

Tip No. 8: Game of Snakes & Ladders: Stock market is like a game of Snakes & Ladders. While everyone is focussed on catching the ladder, it is as important to avoid Snakes as well.

Tip No. 9: Be Realistic About Profits: A strategy doesn't need to win all the time to be profitable. Many traders only win 50% to 60% of their trades. But they make more on winners, than lose on losers. It is important to specify or limit the risk on each single trade, by clearly defining the entry and exit methods adopted.

Tip No. 10: Learnings From Mistakes: Keep notes and reasoning of trades. Your every trade must do either of two things for you a) Increase your confidence in your rules & convictions or b) Teach you a new lesson

Tip No. 11: Avoid Margin Money As Much As Possible: Buying on margin is borrowing money from a broker to purchase stock. For a random example, with Rs. 1 lakh in your account, your broker might allow you to buy securities upto say Rs. 5 lakh. This is Wrong & Dangerous. Use your own capital only for all types of trading, thereby keeping your family and your health safe. Remember, A Broker – Client Relationship is such that if client prospers, broker suffers and if client suffers, broker prospers!

Tip No. 12: Take Breaks, Before It Breaks You, as Health is biggest Wealth: One simply cannot make profits by trading every single day. It is just not on the cards and cannot be done. It is important to allow your mind some cooling periods and weeks in between.

Who Should and Should Not Do Intra Day Trading?

Full Time Engagement: An efficient Intra Day Trading requires continuous monitoring of trends, news developments and of course open positions. For someone engaged full time in a profession / business / employment, a ST / MT / LT Investment offers much better option. On the other hand, If you are full time in markets, with dedication and seriousness (not placing just random bets), Intra Day offers good opportunities to make reasonable profits.

Personal Goals & Return Expectations: For participants requiring certain some of money after certain period of time, with well defined expected rate of return, initial capital and holding period, magic of compounding will work well for them over LT. For others who get satisfaction from daily gains and do want to continuously churn their portfolios, Intraday Trading is a better option.

Capital Constraint: Generally, Participants with ample capital can participate in many number of stocks and yet have free liquidity in account, hence they generally do not restrict themselves to intraday trading. On other hand, participants with limited capital and many profitable ideas on hand, can benefit more by churning their trades in favour of stocks showing right momentum and thus avoid holding period time. For them, Intra Day trading is an equally good option.

However, we strongly advise delivery based investment strategies (be it over short, medium or long term) for overall gains – both monetary and non-monetary.

Rules to Follow when acting on our calls

- This is a Trading Section. Do not put more than 5% of your equity funds in all calls put together.

- Members who are not familiar with F&O or are having no knowledge of F&O, MUST NOT TRADE on these calls.

- SL is advised on closing basis (after 3 pm) & target on real time basis. A cautious trader can put SL on real time.

- Rates given are cash rates and not of Futures.

- Buy / Sell closer to the given levels only and avoid buying / selling closer to the target.

- Trading in F&O is only advised to Members having Growth profile. Since Intraday by its nature is F&O, intraday is not recommended to Members with Balanced or Conservative profiles.

- We give 1 call in this section daily.

- Avoid review of calls till 3 pm by asking queries, as we give exit calls for all calls in this section before market closes.

- Disclosure: Our interest in the call is given in the Disclosure column. 'Have interest' implies we have holding in the stock, while 'No interest' implies we do not have any holding in the stock.

- Rationale for advise: Calls in this section has been given based on fundamentals, technicals, recent news flows and trends, as observed in the market and in the stock.

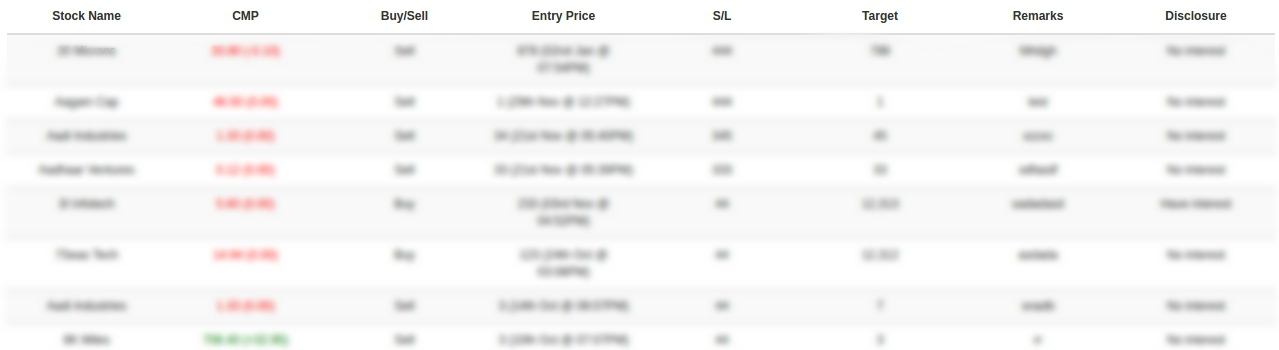

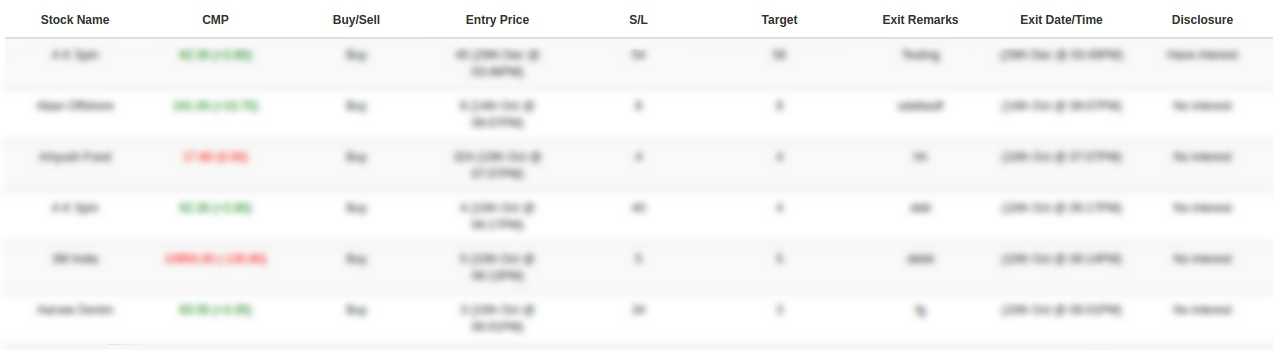

Archives (Last 30 calls)

Popular Comments

|

Ajit (Guest)

11th Mar 2019 at 06:49 pm |

They are overall good

|

|

A Eusobius

16th Dec 2018 at 02:12 pm |

i am only going through the previous transaction to acquaint myself.Remarkable performance. i sincerely feel i am lucky to join a

|

|

Aruna Parag Kamalapurkar

29th Nov 2018 at 10:02 am |

can i get intraday calls recommendations on my mobile no.

|

|

Apoorva Vadhar

27th Nov 2018 at 09:13 am |

It's important to stick to SL level, else, one may loose what is gain over past few days. Do not wait for market to turn around from below SL level

|

|

Umesh Krishnappa

22nd Nov 2018 at 02:11 pm |

Sir what is this golden stocks recommendations, we have to buy both in equities and options it seems pls explain with example sir.

|

|

Manuji Chaubey

15th Nov 2018 at 03:36 pm |

The data being published is somewhat misleading... it was recommended to buy godrej industries at 512 After buying at 511, stop loss got .triggered at 507...Then share rebound to 511.

|

|

Geetanjali Kedia

3rd Aug 2018 at 11:27 am |

@Amar Wakharkar, pls read guideline number 4 to the section, they are cash rates. Thanks

|

|

Amar Wakharkar

3rd Aug 2018 at 11:09 am |

In Intraday Calls Section Rates for Entry Price, SL and Target are FNO Rates or Cash Stock Price rates??

|

|

Niaz

27th Jul 2018 at 09:08 pm |

I have been a member of this portal for more than three years.Ever since I was doing intraday.Around 80 percentage accuracy level is attained consistent ly for the said period.

|

|

Anirudh Pattanayak

29th May 2018 at 11:26 am |

Sir for Today's intraday trade in IGL, the stop loss was hit and then went further below and started rallying till 269.65 . Someone among the members is helping the operators to manipulate.

|

|

Gopinath Kudva

1st May 2018 at 06:10 pm |

Always do self analysis if you lose.I have also lost overall but when I look at all the trades carefully Loses are more due to greed and not following rules set by SPT.

|

|

GAUTAM GUPTA

24th Feb 2018 at 07:41 pm |

Hold many gems recommended by sirji which have given excellent returns over the time Prakas ind@52 .sarda energy @230to name a few.u are GREAT *****

|

|

Rajib Das

17th Feb 2018 at 10:58 am |

Sir given buy 24500 pe and mkt falling ---WHAT A PREDICTION

|

|

Lovish Bajaj

31st Jan 2018 at 10:22 am |

I am happy with service. The calls are good , And hit rate is a lot better than other experts. Just alter the target and SL as per your risk potential .

|

|

Dayalan

2nd Jan 2018 at 11:10 am |

Excellent!sir follows "Don't Ask your advisor which Stock they like,ask them Which stocks they hold in their Portfolio".

A Great Teacher never have Jealous/Greed to share their Knowledge.

|

|

Benjamin G

28th Dec 2017 at 07:54 pm |

Sir I kept just one point down the target and bagged the profit thanks for this Call

Awesome

|

|

Anand Agrawal

22nd Nov 2017 at 06:20 pm |

Hats off you sir. You are hope of us....God bless you

|

|

Samba Vemala

20th Nov 2017 at 09:32 am |

Super ID calls today. The targets met in few seconds . Great Strategy!!

|

|

Kaushik Modak

9th Nov 2017 at 03:23 pm |

Who cares about negative comments in this forum..we know how Sir helps us..earn and be happy..ignore rest!!!

|

|

Swaminathan Gopalakrishnan

9th Oct 2017 at 07:26 pm |

I see many negative comments on intra-day calls. It is clearly mentioned that intra-day calls are like F&O.. Repeated advise to stay away from F&O is falling on deaf years.

|

|

Swapnil Bhole

27th Sep 2017 at 09:46 pm |

I can understand your fundamental positive view on market for MT/LT, but for intraday call also keeping positive view on each session will put your intraday trader in trouble.

|

|

Sudipta Bhattacharya

18th Sep 2017 at 12:01 am |

i joined yesterday....looking everything....ocean of knowledge....proud to be member of spt,,,

|

|

Sreedhar Gandham

7th Sep 2017 at 08:02 pm |

Expecting More Intraday calls real time

plz cover short movement in market like BAFINS today Sir

|

|

Balaji

21st Aug 2017 at 08:01 pm |

Sir, past few days ID calls are best for short at recommended price. Kindly provide short calls also. It will be beneficial. Thank you

|

|

SRINIVASA KANNA KATARI

17th Aug 2017 at 09:39 am |

Thanks for relaunching the older version of spt(desktop version), As i faced lot of problems.

|

|

B Surender Rao

10th Aug 2017 at 07:53 pm |

sir ,

Please give at least one short call for each day.

is there any specific reason for not having the short call

|

|

Balaji

10th Aug 2017 at 12:20 am |

Sir, kindly give sell calls also in a falling market conditions, that will also be very grateful.

|

|

Manisha Thapa

3rd Aug 2017 at 02:51 pm |

Dear Sir,

Getting intraday call at around morning 9:40. Request to give intraday call early.

Thanks

|

|

VAIBHAV

6th Jun 2017 at 12:08 pm |

If you want to make money then you should also have patience, conviction and faith.

|

|

Ramaswamy Gopalan

30th May 2017 at 12:25 pm |

Mr Dilip Patil in a falling mkt naturally probability if loss is more than profit in intraday day. Why you do that. Rather buy good Stk on fall as investment.

|

|

pushpak kumar anand

7th Apr 2017 at 07:34 pm |

risk reward ration in most of the calls are close to 1:1 with accuracy of calls around 72 percent

|

|

Kusam Pcreddy

31st Mar 2017 at 10:51 am |

Prompt analysis

Brilliant prediction sir

|

|

DIBENDU DHAR

21st Feb 2017 at 11:57 am |

hi . your call on Justdial cmp at 400 with tgt of 475 was brillant.. even your call on PTC at 82 with tgt of 125 looks good.. pls advice the subscription process... regards Dibendu Dhar

|

|

PK Pandit (Guest)

11th Feb 2017 at 04:59 pm |

Sir everything is ok but font of word is fade & light. please make it more noticeable

|

|

arun sharma

3rd Feb 2017 at 03:55 pm |

H&M , M&S Fcuk, J&J all this brands are manufcatured by Arvind limited?

|

|

Sunil Saldanha

31st Jan 2017 at 03:03 am |

Im surprised by positive comments but rating 3 star? Please explain y 3 star V.venkata Reddy?

|

|

Sunil Saldanha

31st Jan 2017 at 03:00 am |

For new members & some existing members SPT is our Warren Buffet. You will only make if you can understand, u will only lose by not knowing what your asking!!! Period

|

|

s.shankar

25th Jan 2017 at 08:31 pm |

very good call sir bajaj finance profit earned.thank you sir .

|

|

V.venkata Reddy

22nd Jan 2017 at 11:56 am |

Am very proud be with great adviser Mr.Tulsian. only one deep stock analyser.

|

|

DARSHAN ARVINDBHAI SHAH

2nd Dec 2016 at 01:10 pm |

An ocean of knowledge is what I think mr tulsian is !!

|

|

valluri suresh babu

2nd Dec 2016 at 12:07 pm |

thank u sir

|

|

Puneet kumar bhardwaj

22nd Nov 2016 at 10:56 pm |

Very good tips spt sir...keep it up..

|

|

Sharma, L.V.

3rd Nov 2016 at 03:58 pm |

Very good tipe. Thanks a zillion.

|

|

kolli ramanadha reddy

2nd Nov 2016 at 12:28 pm |

i dont usually trust market tips...but i feel 'very safe'with mr tulsian...keep it up sir..!

|

|

ASHOK RUPANI

21st Oct 2016 at 06:33 pm |

FEELING VERY HAPPY TO BE THE MEMBER WITH GREAT SPT SIR

|

|

thailambal narayanan

18th Oct 2016 at 04:50 pm |

Feeling Happy. Got a good profit in a very short t ime.

Thank you Sir

|

|

thailambal narayanan

18th Oct 2016 at 10:31 am |

very Happy. first tie I got

good profit within a short time.

Thank you Sir

|

|

Suresh

7th Oct 2016 at 08:49 am |

Very good calls

|

|

Amit Bulbule

22nd Sep 2016 at 12:24 pm |

very good call sir

|

|

pankaj

13th Sep 2016 at 03:51 pm |

u r god gift for us,

|

|

satish chand agarwal

11th Sep 2016 at 02:25 pm |

Resp.Sir, learnt very imp lesson from you i.e; boo k profits at given targets..you are the best guru ..Amazing ..made money following you..thnx soooo much

|

|

NITIN GOPAL PATIL

8th Sep 2016 at 02:17 pm |

Both Intra Day Calls rocked! THKs . Though Wockhart hit target @ 1.19 pm - was hovering around 839 for quite some time - and I was about to book profit at lower level since I bought it at 836! Please tell us sir whether such things are advisable or we are supposed to wait & buy at your indicated levels only . Thks !

|

|

Durga

4th Sep 2016 at 10:58 pm |

Sir, Your services are excellent.

i am a big fan of your views.

Respect for you.

Regards,

Du rga Singh

|

|

malay krishna basu

3rd Aug 2016 at 07:32 pm |

Today is the first day and was busy with other job I purchased upl at 588 a nd sold at 594. I am retiring soon from my service with your help I think I can do well.

Best Regar ds

|

|

Swarnendu Chandra

26th Jul 2016 at 11:58 am |

Thank u sir. My 1st day of trading with your tips. Made some profit.

|

|

Manish S Mishra

11th Jul 2016 at 03:50 pm |

Prompt feedback.

correct & detailed info.

strong analysis team.

Believes in sharing true news , n o fake threat.

|

|

JAYESH P. SHUKLA

6th Jul 2016 at 10:40 am |

Resp. Sir,

You have taught one Mantra i.e. "Learn to book profits" If you have an instant gain of 10/12% book it. Sir, I did the same in JP Associates yesterday and gained a good amount.

THANK YOU VERY MUCH SIR

|

|

Ankit Gupta

30th Jun 2016 at 12:43 pm |

Yor are really Rockstar.

|

|

kvslk praveen

16th Jun 2016 at 09:16 pm |

sir namaste. u have a terrific knowledge about Indian companies and their stock prices. Unbeleivable and mind boggling.

|

|

parekh

13th May 2016 at 06:52 pm |

I am following your intraday call for the first time and i am fully satisfied with both of your stocks because both glenmark & uco banks and have met the target.. Thankyou & looking forward for your tips

|

|

Rahul S Trivedi

6th May 2016 at 03:27 pm |

Gr8 call you have been a great advisor. Always keep waiting for your intera day call and the call in option

|

|

THIMMESH BC

24th Feb 2016 at 02:12 pm |

Excellent.

|

|

ransingh chauhan

5th Jan 2016 at 09:54 am |

good call sirf

|

|

DESAI KRISHNA

18th Dec 2015 at 09:49 pm |

Not bad in this market conditions

|

|

Nagabhushana N.S

5th Nov 2015 at 08:37 pm |

I learned many many ideas from your stock query an d inra day calls are good and I have full faith si r.

|

|

siddalingeshwara h c

30th Oct 2015 at 11:28 am |

nice calls..

|

|

Nagabhushana N.S

14th Oct 2015 at 04:08 pm |

supereb

|

|

R.Sivakumar

29th Sep 2015 at 12:33 pm |

sir for long time back i subscrip u at the time i got star calls, 1 star 3 star 5 stars, but i subscripted 2 days bank all our calls are nse cash only, how to get f&o calls

|

|

PERTISTH MANKOTIA

18th Sep 2015 at 11:36 pm |

I was searching for the Better. The Best You can advice because sir you are more then the Best.

|

|

PERTISTH MANKOTIA

15th Sep 2015 at 10:40 pm |

learning is an ongoing process. Good to have such Tool.

|

|

Harshad R Raut

5th Aug 2015 at 03:20 pm |

All calls are good and I have full faith in Tulsian sir.

|

|

SANJAY

24th Jul 2015 at 04:03 pm |

undoubtedly.....excellent . cheaper in subscription and excellent in service . Hats off to Tulsian Sir for doing outstanding wo rk for his members. No one other Analysts can think of giving such type of service.... Mindblowing

|

|

SANJAY GUPTA

14th Jul 2015 at 09:22 pm |

Genius in Stock Market

|

|

Vashim Mazhar

10th Jul 2015 at 10:48 pm |

Looks nice...

|

|

sandip kamble

9th Jul 2015 at 05:45 pm |

SIR U ARE BEST

|

|

sunil kumar

23rd Jun 2015 at 08:13 am |

SIR, I M A BIG FAN OF YOU, I HAVE FOLLOW UR RECOMMENDATION ON CNBC AWAAJ AND MAKE PROFIT. I AM A SMA INVESTOR SINCE 2005.BUT NOW I START TRADING.PEOPLE WILL LAUGH BUT I M SAYING I WANT TO BECOME WARREN BUFFEY. I M AN ELECTRICAL ENGR IN PSU OMC......SUNIL KUMAR

|

|

Narendra Palkar

11th Jun 2015 at 10:49 am |

Dear Sir, Good morning. Market likely to come up. I had buy 1000 nos @290 of hexaware for intraday. Regards

|

|

vinod kumar raina

18th May 2015 at 10:26 am |

exellent

|

|

satyajit

8th May 2015 at 11:44 am |

Thanks sir supper intraday calls Ashok & Tata both calls hit

|

|

Ratheesh Anedath

29th Apr 2015 at 03:09 pm |

super intraday calls wockhardt and tvs motor

|

|

saraswathy

21st Apr 2015 at 03:24 pm |

Sir, Excellent call on ID today, Hats off to u G, thank u sir, Last 3 months I did not get support from u, truly I didn't earn anything, yesterday I renewed account today made profit. thank u sir.

|

|

yashpal sharma

30th Mar 2015 at 11:05 am |

Good decision taken on stopping intraday calls as it isn't wise to take 10% risk for gain of 1%. Eve n you have mentioned that it is too risky but memb ers cant stop themselves as they have blind trust on your calls.

|

|

abdulla kunhi

23rd Mar 2015 at 02:01 pm |

Again SPT is in full form like indian team in Intr aday calls.My heartly congratulation.

|

|

yashpal sharma

11th Mar 2015 at 05:10 pm |

I just understood "to play safe, can put SL on real time, that largely seems trap". I followed SL on realtime and loosing mon ey.Now I'll wait till you provide inputs.

|

|

Dhilipkumar V

2nd Mar 2015 at 08:41 pm |

Today is the first trading after registering to SPTulsian. calls are perfect. it improves my confident.

|

|

Abhishek Kr Verma

25th Feb 2015 at 10:26 pm |

Great Sir. This will really help investors to save their hard earned money.

|

|

SHAISHAV

21st Feb 2015 at 10:33 am |

All calls really perfect like Sachin six

|

|

abhishek

19th Feb 2015 at 01:07 pm |

Intraday calls today rocked.. in choppy markets..

|

|

amit

17th Feb 2015 at 11:51 pm |

sir i m very small person to say u anything

just want to say u r right person for public

|

|

HIREN S PARMAR

11th Feb 2015 at 03:14 pm |

Very good sir, Good call at perfect time, with perfect price.

|

|

Balasubramanian P.K.

6th Feb 2015 at 09:54 pm |

Sir, my suggestion given below; if acceptable, kindly implement the same. for intraday calls on sms, since cmp is known, please give only scrip name, SL and Target in sms. T ime lost for searching in your internet site.

Th anking you

Bala-kb

|

|

Samir

4th Feb 2015 at 07:31 pm |

Really outstanding service.

The subscription charges are just like token charge to avoid unnacessary rush.

|

|

Sanjay Bohra

21st Jan 2015 at 10:04 pm |

Respected Sir

I have renewed my membership yesterday for three months as i have regarded you as an honest and informed analyst since 2004 when i started following you on CNBC. You give off beat stocks that no other analyst would ever mention. It is because of faith in you i have bought stocks like grauer and weil, kopran, lgbforge etc. despite the fall of 800 points, i di dn't panic only because pf you. However, there is one point i would like to mention hope you would n ot take it otherwise. I have to a

|

|

VENKATESAN.G

31st Dec 2014 at 12:32 pm |

Sir your option calls very accuracy thank u sir.I am happy trading...

|

|

vikas dubey

30th Dec 2014 at 02:44 am |

sir ur best

|

|

AJAY CHADHA

21st Dec 2014 at 09:03 pm |

Thanks for your valuable information

|

|

nc mathur

30th Nov 2014 at 05:54 pm |

Sir, Started trading from 27 nov2014. Enjoyed prof it sharing as other clients. On both working session got profit. Thanx for inducing self confidence.

|

|

Hemant

19th Nov 2014 at 05:10 pm |

Hello Sir;

Thanks a lot for his ready list of dangerous stocks.

This will save lot of investors an d make their confidence stay in market.

Sir just by few romours i have bought Cals refinery.

Just wanted to know from you is that stock also to accounted this list or there is some genunity in the counter.

|

|

rupam sinha

18th Nov 2014 at 08:36 pm |

sir, I am a new entrant. Your BUY ID calls are excellent 80 % accurate. But SELL calls needs review in my humble openion.

Enjoyed profit in bharat forge and crompton. Keep up good work.

|

|

k.v.

16th Nov 2014 at 12:04 pm |

Sir,Wonderfull calls Mr S.P.T.,Certain calls hit target BEFORE SMS'S reaches.Kindly give advice how to overcome this issue.We see the target reaching even before we take positions, by the time sms's reaches us its hit the target.

|