NSDL

IPO Size: Rs. 4,012 cr, entirely Offer For Sale (OFS)

- By financial investors IDBI Bank (26% stake to reduce to 15%), NSE (24% to drop to 15%) and part-exit by Union Bank of India, HDFC Bank, SBI, Administrator of UTI.

- IPO is to comply with SEBI regulations of no single entity to have over 15% stake in Market infrastructure institution (MII); Depository is a MII

Price band: Rs. 760-800 per share

M cap: Rs. 16,000 cr, implying 25% dilution

IPO Date: Wed 30th Jul to Fri 1st Aug 2025, Listing Wed 6th Aug 2025

Grey Market Premium (GMP): We are strongly against ‘grey market premium’ as it is an unofficial figure, against SEBI guidelines.

India’s First Depository

National Securities Depository Limited (NSDL), established in Nov 1996, is India’s oldest depository in the duopoly industry, with 3.95 crore demat accounts. With no identifiable promoter, NSDL is an associate company of NSE, with listing only on BSE (similar to CDSL being listed only on NSE).

Smaller and Less Profitable than CDSL

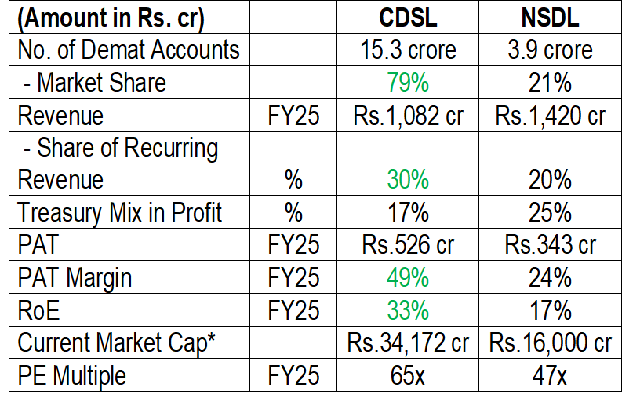

*as of 25.7.25 for CDSL on CMP of Rs. 1,635 per share, at upper price band for NSDL

CDSL has a higher number of demat accounts, with higher profit, both in absolute and percentage terms, despite a lower topline. CDSL’s cost management is better than NSDL and it earns higher ‘core’ income, with treasury being 17% of profit mix, as against 25% for NSDL. Even CDSL’s RoE of 33% is nearly double NSDL’s 17%, for FY25, indicating CDSL’s fundamentals are superior to NSDL.

‘Left Money on the Table’

Mcap of Rs 16,000 cr implies a historic PE multiple of 47x, based on FY25 EPS of Rs. 17. This is lower than CDSL’s PE of 65x. NSDL’s mcap is 47% of CDSL, when its PAT is 65%. Thus, IPO pricing adequately factors in NSDL’s relatively weaker financial position.

On FY26E EPS of about Rs.20, current year PE multiple for NSDL is at 40x, which has room to expand, given duopoly industry and low penetration of 7% of capital markets in the country.

26th Jul 2025 at 09:29 am